Ah, the world of tax forms! It can be quite overwhelming, but fear not! I’m here to help you navigate through one particular form that you might come across - the W-9 form. Whether you are a freelancer, an independent contractor, or a small business owner, understanding the ins and outs of the W-9 form is essential. So, let’s dive in!

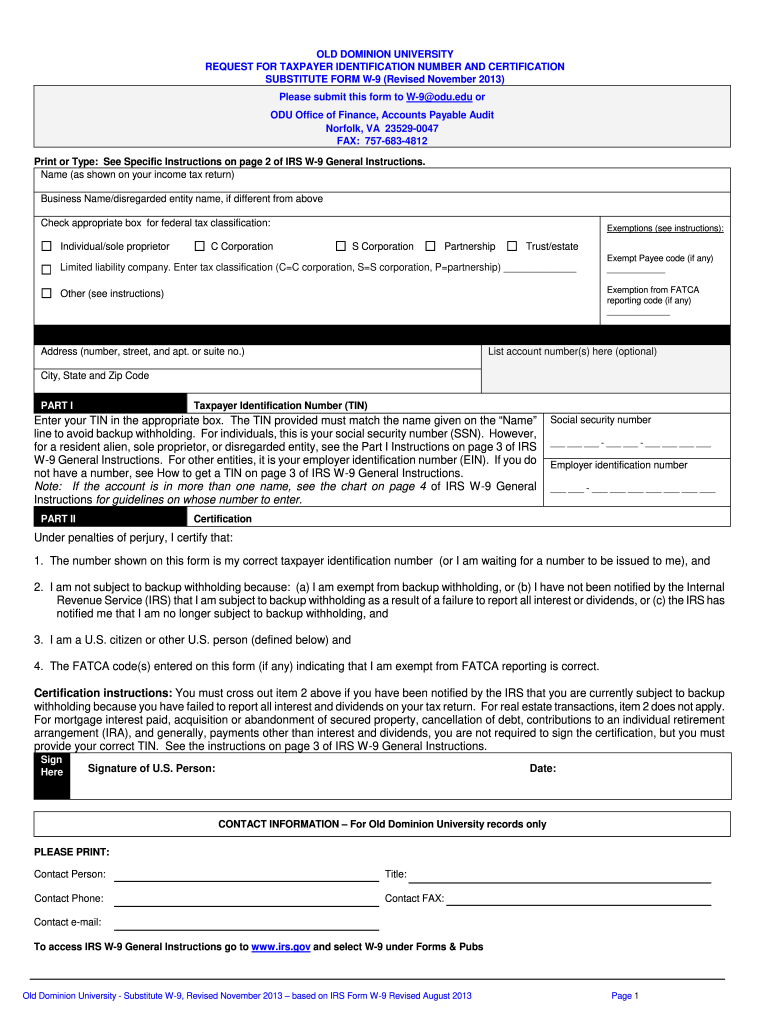

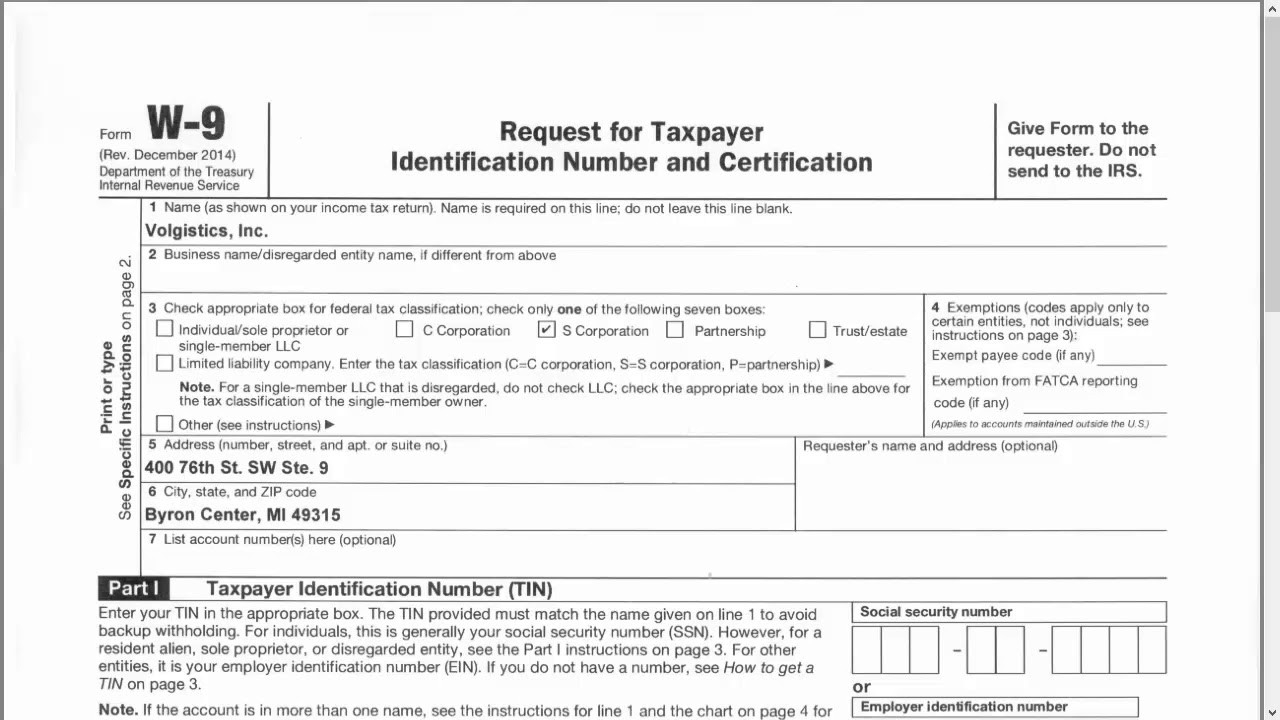

A Handy Printable W-9 Form

First things first, if you need a blank W-9 form to fill out, look no further! You can easily find a printable version of the formhere. It provides a clear layout and makes the process of completing the form a whole lot easier.

First things first, if you need a blank W-9 form to fill out, look no further! You can easily find a printable version of the formhere. It provides a clear layout and makes the process of completing the form a whole lot easier.

Filling Out and Signing the Form

Once you have your blank W-9 form in hand, it’s time to fill it out. The form requires basic information such as your name, address, and taxpayer identification number. It’s important to double-check your entries and ensure accuracy. Additionally, sign the form to certify that the information you provided is true and correct.

Once you have your blank W-9 form in hand, it’s time to fill it out. The form requires basic information such as your name, address, and taxpayer identification number. It’s important to double-check your entries and ensure accuracy. Additionally, sign the form to certify that the information you provided is true and correct.

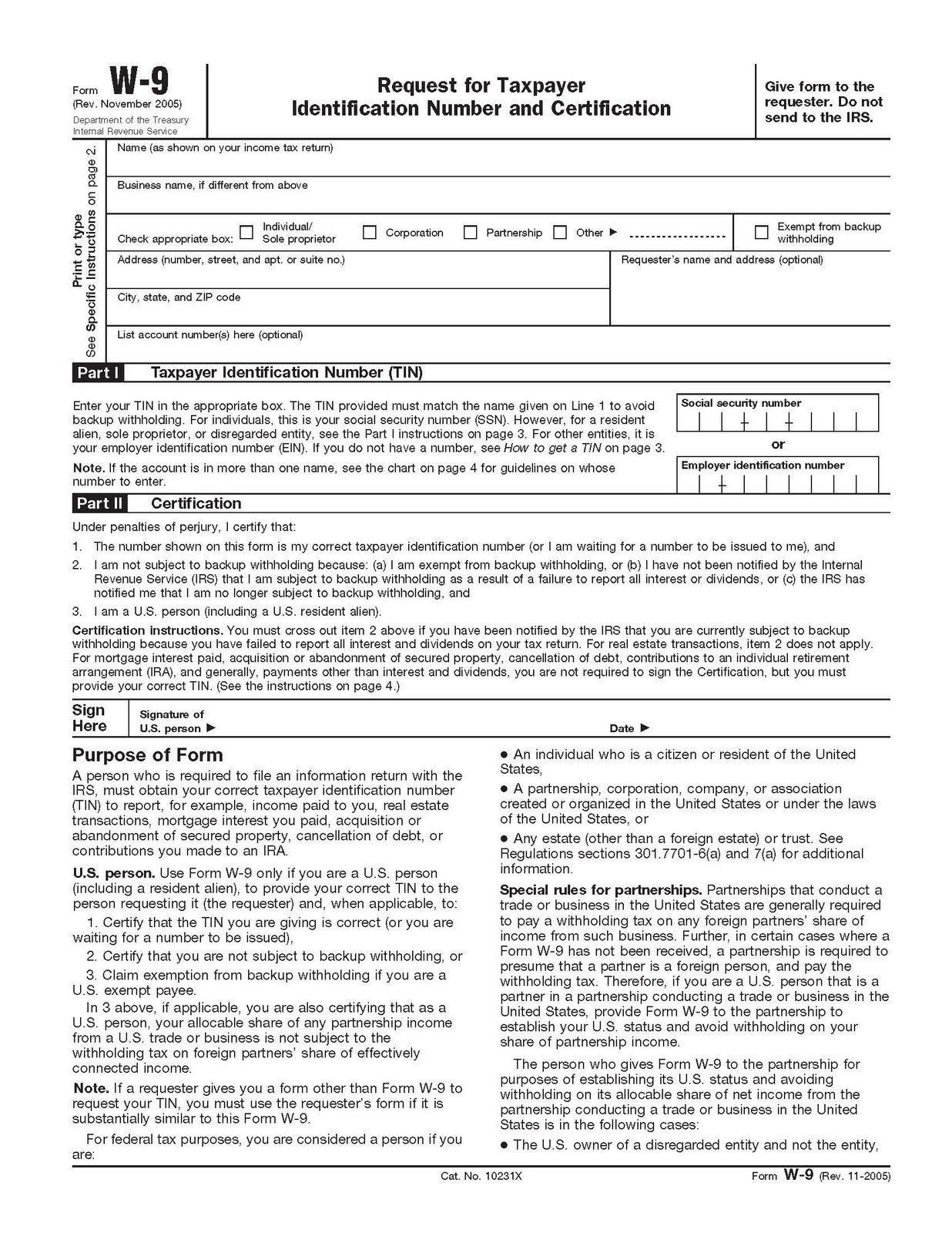

State W9 Forms

Did you know that some states have their own version of the W-9 form? If you operate within a specific state, it’s crucial to check if they require you to complete their state-specific form in addition to the federal W-9 form. These state-specific forms might have slight variations, so make sure to use the right one!

Did you know that some states have their own version of the W-9 form? If you operate within a specific state, it’s crucial to check if they require you to complete their state-specific form in addition to the federal W-9 form. These state-specific forms might have slight variations, so make sure to use the right one!

Keeping Track of your W-9 Forms

As a responsible taxpayer, keeping track of your W-9 forms is essential. You might need these forms for tax reporting purposes, so it’s a good practice to save a digital and physical copy of each completed form. Organize them in a safe place, and you’ll find it much easier to retrieve them when needed.

As a responsible taxpayer, keeping track of your W-9 forms is essential. You might need these forms for tax reporting purposes, so it’s a good practice to save a digital and physical copy of each completed form. Organize them in a safe place, and you’ll find it much easier to retrieve them when needed.

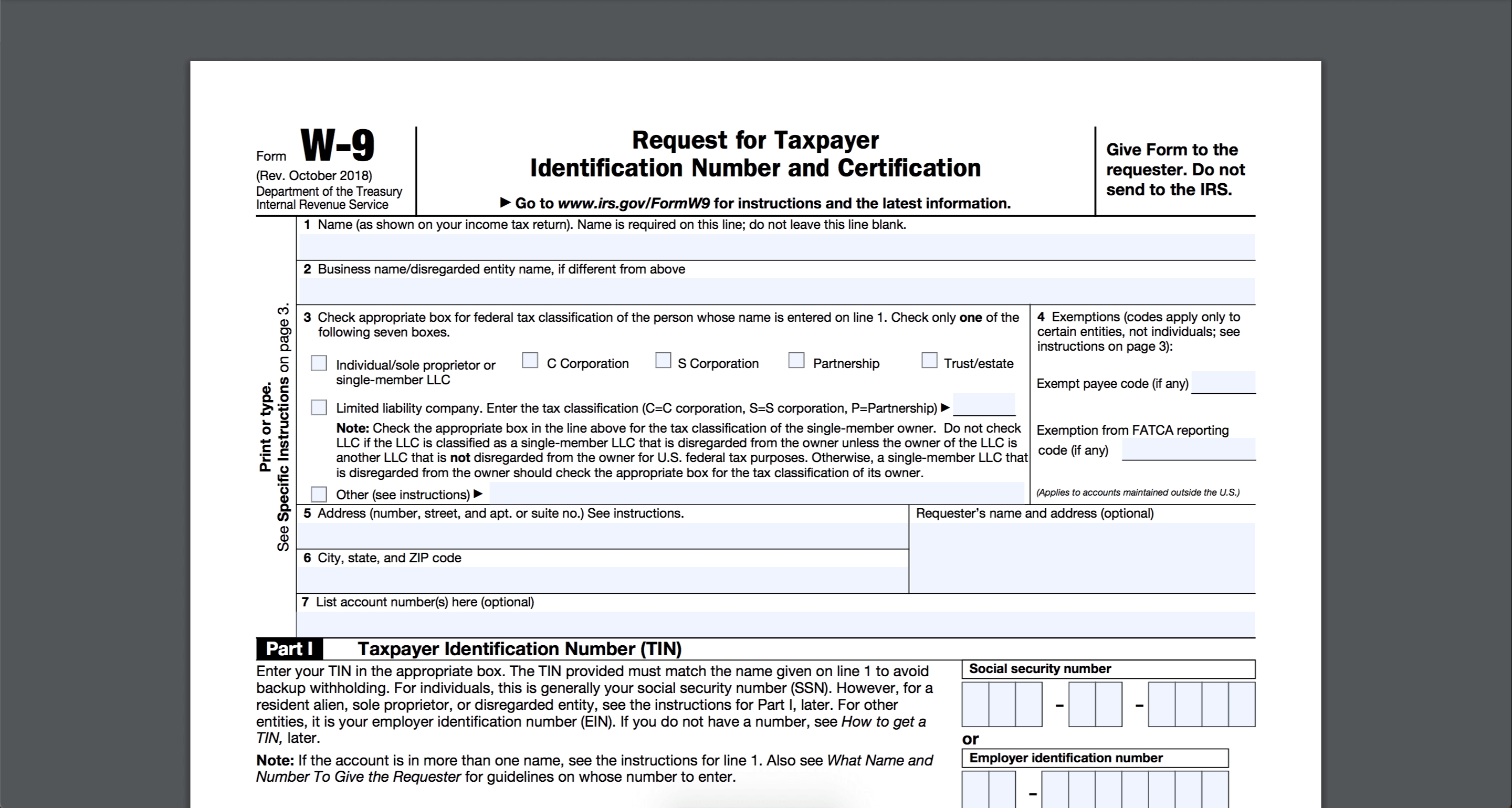

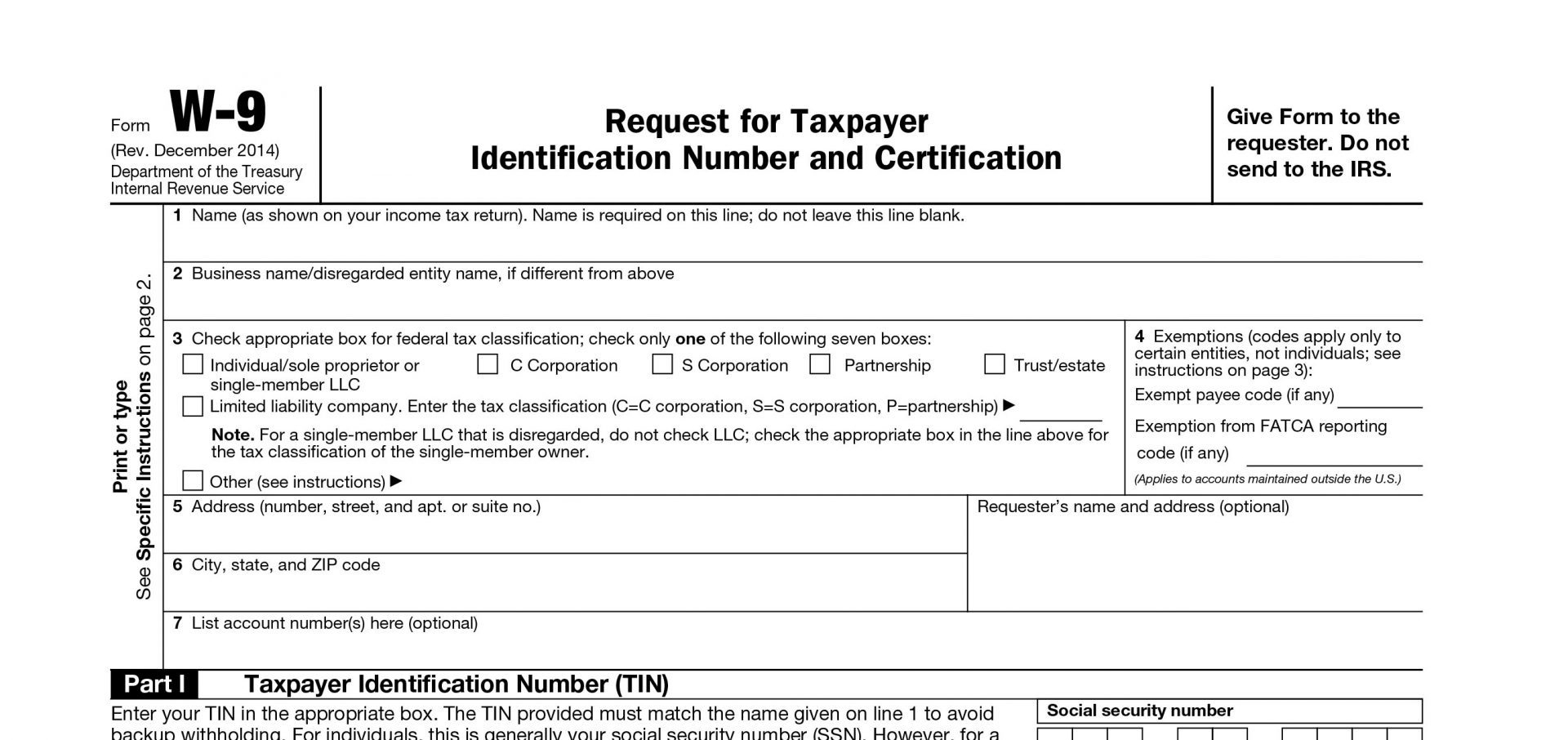

Updated Blank W-9 Form for 2021

Every year, the IRS may make updates to the W-9 form. If you are inquiring about the most recent version, look no further! You can find a downloadable and printable blank W-9 form for 2021 here. Stay up-to-date and ensure compliance with the latest requirements.

Every year, the IRS may make updates to the W-9 form. If you are inquiring about the most recent version, look no further! You can find a downloadable and printable blank W-9 form for 2021 here. Stay up-to-date and ensure compliance with the latest requirements.

Understanding the Purpose of the W-9 Form

Now, let’s talk about why the W-9 form is so crucial. The primary purpose of this form is to gather your taxpayer identification number (TIN) or Social Security Number (SSN) from individuals or entities who may need to report certain types of payments to the IRS. Essentially, it helps the payer properly report income paid to you. So, make sure to provide accurate information and help everyone involved stay on the right side of the law!

Now, let’s talk about why the W-9 form is so crucial. The primary purpose of this form is to gather your taxpayer identification number (TIN) or Social Security Number (SSN) from individuals or entities who may need to report certain types of payments to the IRS. Essentially, it helps the payer properly report income paid to you. So, make sure to provide accurate information and help everyone involved stay on the right side of the law!

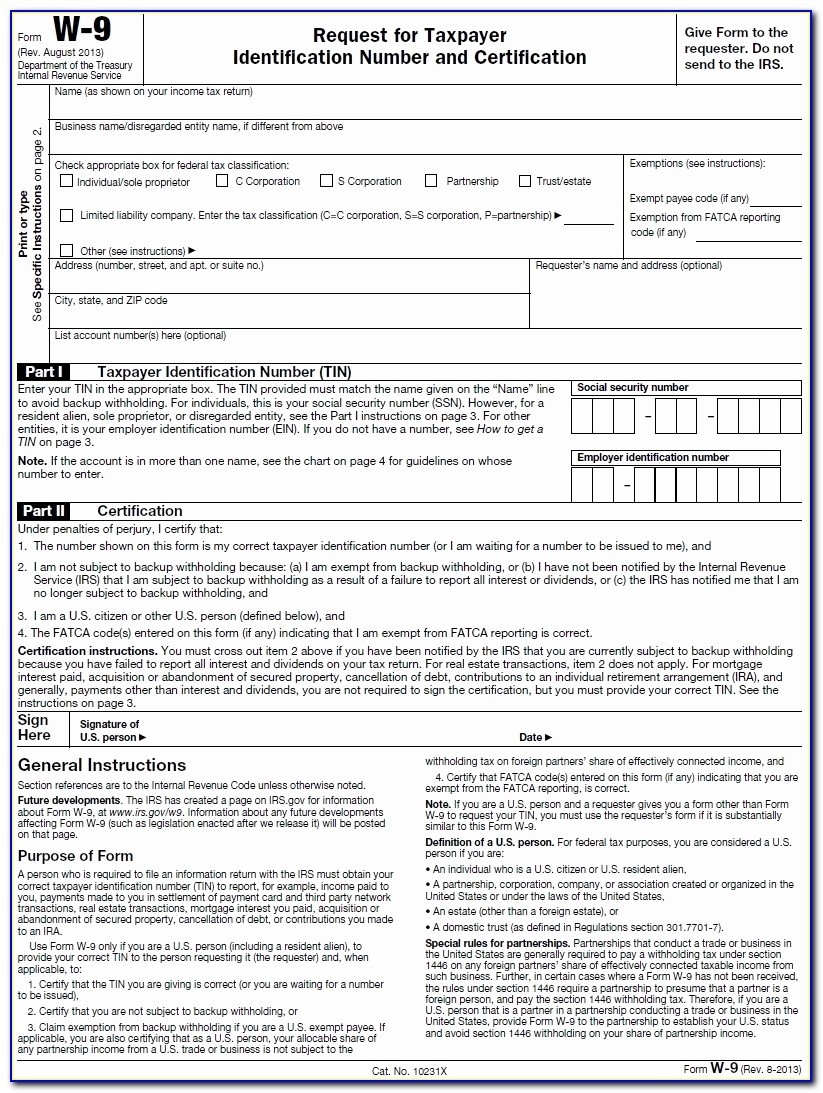

Looking for a Blank W-9 Form Online?

Are you in search of a blank W-9 form but not sure where to find it? Don’t worry; it’s simpler than you might think! You can find a printable version of the form here. Just click the link, and you’ll have access to a clean, ready-to-fill blank W-9 form.

Are you in search of a blank W-9 form but not sure where to find it? Don’t worry; it’s simpler than you might think! You can find a printable version of the form here. Just click the link, and you’ll have access to a clean, ready-to-fill blank W-9 form.

The Importance of the W-9 Form

While the W-9 form may seem just like another bureaucratic requirement, it serves an important purpose. By completing this form accurately, you are ensuring that you pay your taxes correctly and that businesses properly report any payments made to you. It’s a small step that has a significant impact on the integrity of the tax system.

The Convenience of a Free Printable W-9 Form

Lastly, there’s no need to stress about finding a printable W-9 form. You can easily access a free printable version online. Feel free to click hereand get your hands on a blank W-9 form that you can print, fill out, and submit hassle-free.

Lastly, there’s no need to stress about finding a printable W-9 form. You can easily access a free printable version online. Feel free to click hereand get your hands on a blank W-9 form that you can print, fill out, and submit hassle-free.

So, there you have it! A comprehensive guide to the W-9 form, complete with easy access to printable versions, tips on filling it out, and the importance of accuracy. Remember, when it comes to tax forms, a little attention to detail goes a long way. Happy organization and accurate reporting!