Irs Printable 1099 Form - Printable Form 2023

Are you ready to conquer your taxes and streamline your financial record-keeping? Look no further than the IRS Printable 1099 Form! This handy form is essential for reporting various types of income, and it’s a must-have for anyone looking to stay on the right side of the law come tax season.

With the IRS Printable 1099 Form, you can ensure that your income is accurately reported and that you’re on track to meet your tax obligations. This form is especially useful for independent contractors, freelancers, and other self-employed individuals who receive income from various sources.

With the IRS Printable 1099 Form, you can ensure that your income is accurately reported and that you’re on track to meet your tax obligations. This form is especially useful for independent contractors, freelancers, and other self-employed individuals who receive income from various sources.

By using this form, you’ll be able to report all of your income in a clear and concise manner, minimizing the risk of errors or omissions. This not only helps you comply with tax laws but also makes it easier for the IRS to process your return and issue any refunds you may be entitled to.

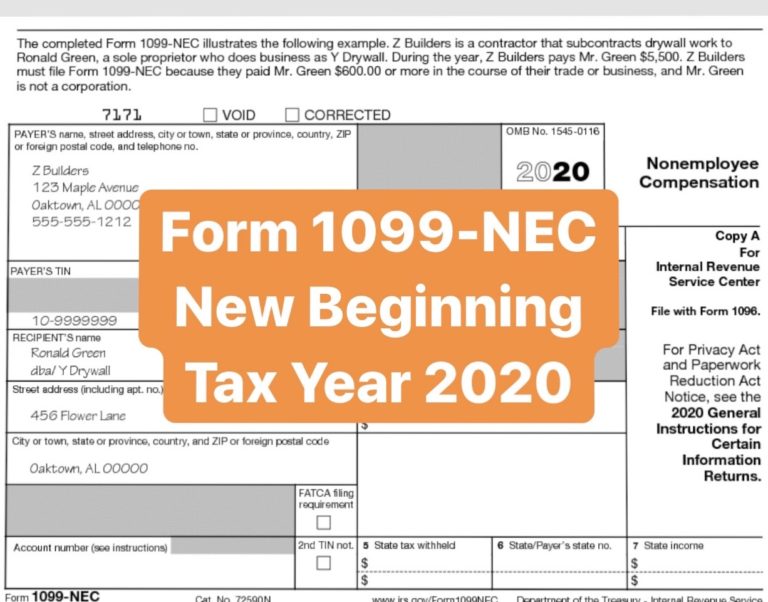

Preparing for 2020 Non-Employee Compensation Form 1099-NEC

If you’ve received non-employee compensation during the 2020 tax year, it’s essential to familiarize yourself with the Form 1099-NEC. This form replaces the previous use of Box 7 of Form 1099-MISC for reporting non-employee compensation.

The Form 1099-NEC is specifically designed to report income paid to independent contractors, freelancers, and other non-employees. By using this form, businesses can accurately report the income they’ve paid to individuals who aren’t classified as employees.

The Form 1099-NEC is specifically designed to report income paid to independent contractors, freelancers, and other non-employees. By using this form, businesses can accurately report the income they’ve paid to individuals who aren’t classified as employees.

When preparing for the 2020 tax year, it’s important to ensure that you have the necessary information to complete Form 1099-NEC. This includes the name and address of the recipient, their taxpayer identification number (TIN), and the total amount of non-employee compensation they received.

Once you have all the required information, you can easily fill out Form 1099-NEC and provide a copy to the recipient. It’s crucial to file this form with the IRS by the specified due date to avoid any penalties or fines for late submission.

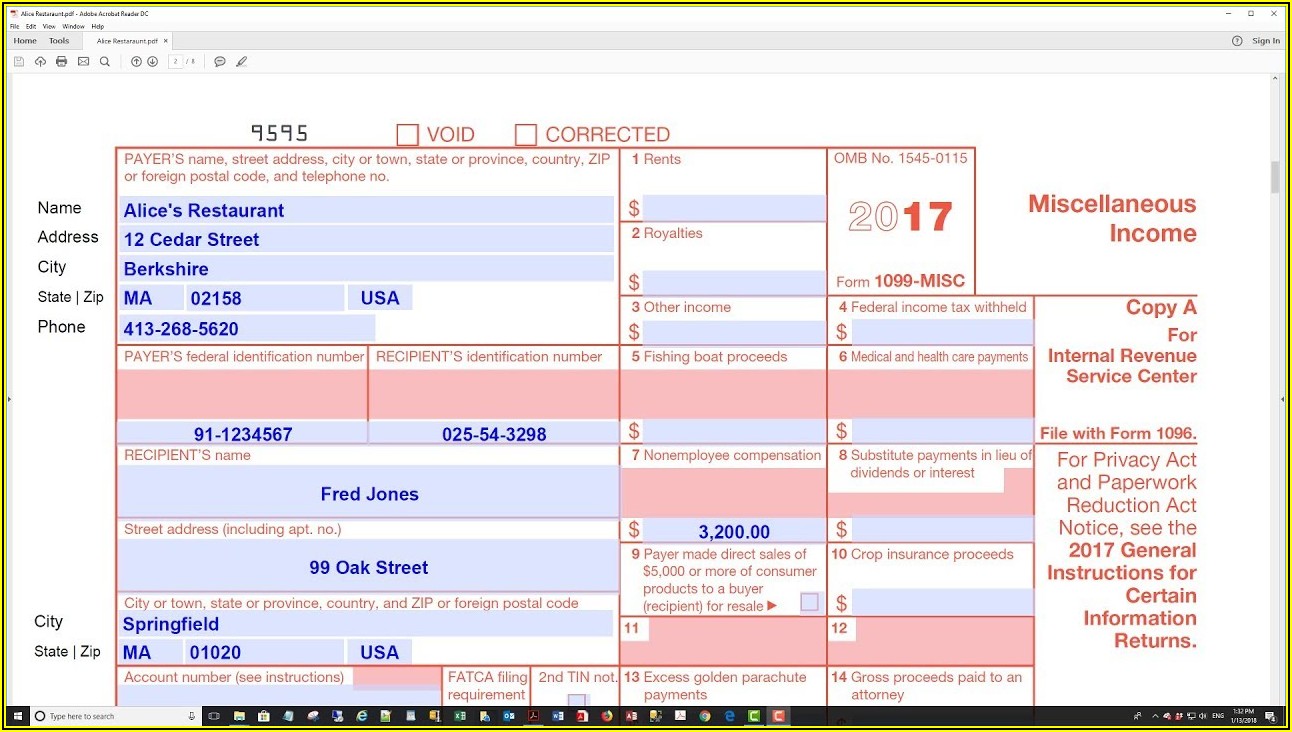

1099-MISC or 1099-NEC? What You Need to Know about the New IRS

The IRS recently made a significant change that affects how businesses report non-employee compensation. In previous years, businesses used Form 1099-MISC to report this type of income. However, starting with the 2020 tax year, non-employee compensation must now be reported on Form 1099-NEC.

This change is intended to streamline the reporting process and provide clearer guidelines for businesses. By separating non-employee compensation from other types of income, the IRS aims to improve accuracy and reduce confusion.

This change is intended to streamline the reporting process and provide clearer guidelines for businesses. By separating non-employee compensation from other types of income, the IRS aims to improve accuracy and reduce confusion.

It’s important for businesses to familiarize themselves with this change and ensure they are using the correct form when reporting non-employee compensation. Failing to use Form 1099-NEC could result in penalties or delays in processing your tax return.

Remember, the Form 1099-NEC is specifically designed for reporting non-employee compensation, while Form 1099-MISC is still used to report other types of miscellaneous income. It’s crucial to understand the distinction and use the appropriate form to ensure compliance with the IRS requirements.

[最も好ましい] 1099 c form 2020 166315-2020 form 1099-c cancellation of debt

When it comes to navigating the complex world of taxes, understanding the various forms and their specific uses is crucial. One such form that you may encounter is the 1099-C, also known as the “Cancellation of Debt” form.

The 1099-C form is used to report canceled debts that exceed $600. When a creditor cancels or forgives a debt, they are required to report this amount to both the debtor and the IRS. This helps the IRS track and tax any canceled debts that may be considered taxable income.

It’s important to note that not all canceled debts are taxable. Some exceptions apply, such as when the debt cancellation is due to bankruptcy or insolvency. In such cases, the canceled debt may not be considered taxable income.

However, it’s always wise to consult with a tax professional or use reputable tax software to ensure you correctly report any canceled debts. Failing to report taxable canceled debts could result in penalties and additional tax liabilities.

What is Form 1099-NEC for Nonemployee Compensation

Are you an independent contractor or freelancer who provides services to businesses? If so, understanding the Form 1099-NEC is essential for reporting your nonemployee compensation accurately.

The Form 1099-NEC is specifically designed to report nonemployee compensation, such as fees, commissions, or other forms of payment received for services provided as an independent contractor. By using this form, you can ensure that your income is accurately reported to the IRS.

The Form 1099-NEC is specifically designed to report nonemployee compensation, such as fees, commissions, or other forms of payment received for services provided as an independent contractor. By using this form, you can ensure that your income is accurately reported to the IRS.

It’s important to note that businesses are required to provide a copy of Form 1099-NEC to anyone who received $600 or more in nonemployee compensation during the tax year. This ensures that both the recipient and the IRS have accurate records of the income earned.

As an independent contractor or freelancer, it’s your responsibility to accurately report your income and fulfill your tax obligations. The Form 1099-NEC provides a standardized way to report your nonemployee compensation and avoids any confusion or discrepancies.

What is Form 1099-NEC and Who Needs to File?

If you’re an employer or a business that uses the services of independent contractors, it’s crucial to understand the Form 1099-NEC and who needs to file it. This form is used to report nonemployee compensation and ensure compliance with IRS regulations.

Any business that pays $600 or more in nonemployee compensation during the tax year must file Form 1099-NEC. This includes payments made to independent contractors, freelancers, and other non-employees who provide services to your business.

Any business that pays $600 or more in nonemployee compensation during the tax year must file Form 1099-NEC. This includes payments made to independent contractors, freelancers, and other non-employees who provide services to your business.

By filing this form, you ensure that the IRS receives accurate information about the nonemployee compensation paid by your business. This allows the IRS to track income and ensure that individuals who receive this income fulfill their tax obligations.

It’s crucial to keep accurate records of any nonemployee compensation payments made throughout the year. This includes the recipient’s name, address, and taxpayer identification number (TIN). Failing to provide accurate information on Form 1099-NEC could result in penalties or delays in processing your tax return.

New 1099-NEC Form For Independent Contractors | The Dancing Accountant

Attention, independent contractors! The IRS has introduced a new form specifically for you – the 1099-NEC. This form is designed to report nonemployee compensation accurately and ensure compliance with tax regulations.

The 1099-NEC form addresses a significant change in how businesses report nonemployee compensation. It separates this type of income from other miscellaneous income that was previously reported on Form 1099-MISC in Box 7.

The 1099-NEC form addresses a significant change in how businesses report nonemployee compensation. It separates this type of income from other miscellaneous income that was previously reported on Form 1099-MISC in Box 7.

By using the new Form 1099-NEC, independent contractors can rest assured that their nonemployee compensation is being reported accurately. This form helps eliminate potential confusion and ensures that businesses are complying with IRS requirements.

When tax season rolls around, it’s essential for independent contractors to keep track of their income and expenses throughout the year. This includes documenting any nonemployee compensation received and using this information to complete the Form 1099-NEC.

Understanding 1099 Form Samples

If you’ve ever encountered a 1099 form, you may have wondered what it’s all about and how to navigate its complexities. Understanding the various 1099 forms is crucial for staying compliant with IRS regulations and accurately reporting your income.

The 1099 forms cover a wide range of income reporting. These forms are used to report income other than wages, tips, and salaries. They often apply to self-employed individuals, freelancers, and independent contractors who receive income from sources other than traditional employers.

The 1099 forms cover a wide range of income reporting. These forms are used to report income other than wages, tips, and salaries. They often apply to self-employed individuals, freelancers, and independent contractors who receive income from sources other than traditional employers.

Each 1099 form serves a specific purpose. For example, the 1099-NEC form is used to report nonemployee compensation. On the other hand, the 1099-MISC form covers a broader range of miscellaneous income, such as rents, royalties, or prizes.

Understanding these forms and their respective uses is essential for accurately reporting your income and fulfilling your tax obligations. If you’re unsure about which form applies to your situation, it’s always a good idea to consult with a tax professional or use reputable tax software to ensure compliance.

Irs Form 1099 Misc - Form : Resume Examples

For individuals who receive miscellaneous income and are not classified as employees, the IRS Form 1099-MISC is a critical document. This form helps ensure that this type of income is accurately reported and subject to the proper tax treatment.

Form 1099-MISC covers a wide range of miscellaneous income, including rents, royalties, and other types of payments made to service providers who aren’t classified as employees. It’s essential for businesses to provide this form to individuals who meet the specified income thresholds.

Form 1099-MISC covers a wide range of miscellaneous income, including rents, royalties, and other types of payments made to service providers who aren’t classified as employees. It’s essential for businesses to provide this form to individuals who meet the specified income thresholds.

By using the Form 1099-MISC, businesses and individuals can ensure that all income is accurately reported. This helps ensure compliance with tax regulations and reduces the risk of penalties or fines for underreporting or failing to report miscellaneous income.

Whether you’re a business owner or a recipient of miscellaneous income, it’s essential to understand the requirements and obligations associated with the Form 1099-MISC. By doing so, you’ll be better equipped to navigate tax season and fulfill your tax obligations.

Form 1099-NEC for Nonemployee Compensation | H&R Block

Attention, independent contractors and freelancers! The Form 1099-NEC is the key to accurately reporting your nonemployee compensation and ensuring compliance with IRS regulations. If you receive income from various sources outside of traditional employment, this form is a must-have.

Form 1099-NEC is specifically designed to report payments made to non-employees, such as independent contractors, freelancers, and other service providers. By using this form, businesses can accurately report the compensation paid and provide the necessary documentation to recipients and the IRS.

Form 1099-NEC is specifically designed to report payments made to non-employees, such as independent contractors, freelancers, and other service providers. By using this form, businesses can accurately report the compensation paid and provide the necessary documentation to recipients and the IRS.

If you fall into the category of non-employee compensation recipients, it’s crucial to keep accurate records of your income throughout the tax year. Having a record of all payments received and using this information to complete Form 1099-NEC will ensure that your income is accurately reported.

By staying on top of your tax obligations and correctly reporting your nonemployee compensation, you can avoid potential penalties or fines. The Form 1099-NEC is your ticket to compliant and stress-free tax preparation.

In conclusion, understanding and correctly using the various IRS forms, such as the 1099 series, is crucial for accurate income reporting and compliance with tax regulations. Whether you’re an independent contractor, freelancer, or a business owner, knowing which form to use and how to fill it out ensures that your income is reported accurately to the IRS. Keep track of your income, consult with professionals when needed, and stay informed about any updates or changes to the forms to stay ahead of your tax obligations. By utilizing the IRS Printable 1099 Form, preparing for the 2020 Non-Employee Compensation Form 1099-NEC, understanding the differences between 1099-MISC and 1099-NEC, and being familiar with other 1099 forms, you can ensure a smoother tax season and minimize the risk of penalties for noncompliance. Stay informed, stay organized, and stay on top of your taxes!